Mastering Your Accounts With Bookkeeping 7637606200

Mastering accounts through bookkeeping is a critical endeavor for individuals and businesses alike. It involves a systematic approach to maintaining financial records, ensuring compliance with regulations. The choice of tools and software can significantly impact efficiency and accuracy. Furthermore, understanding tax deductions and financial reporting is essential for optimizing outcomes. As the complexities of financial management increase, the importance of effective bookkeeping cannot be overstated. What strategies can enhance these practices for better fiscal health?

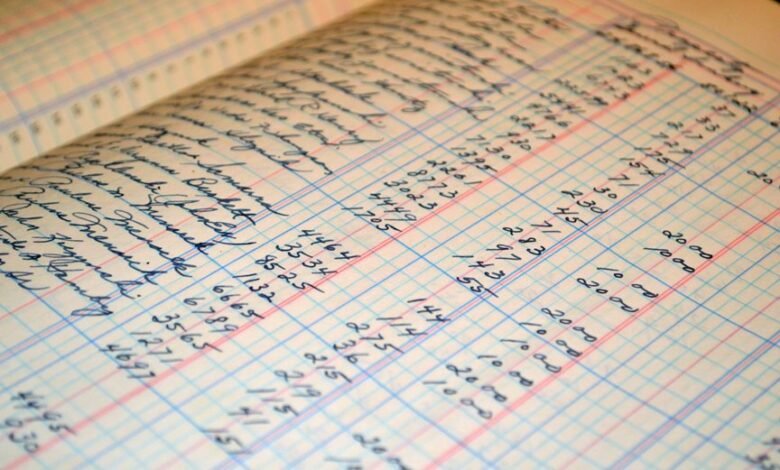

Understanding the Basics of Bookkeeping

Bookkeeping serves as the foundational pillar of effective financial management for any organization.

Adhering to core bookkeeping principles enhances financial literacy, enabling stakeholders to make informed decisions. Accurate record-keeping ensures transparency, facilitates compliance, and empowers individuals to understand their financial position.

Essential Bookkeeping Tools and Software

Effective financial management relies heavily on the right tools and software to streamline bookkeeping processes.

Cloud accounting systems enable real-time access to financial data, enhancing collaboration and decision-making.

Additionally, robust expense tracking applications facilitate meticulous monitoring of expenditures, promoting fiscal discipline.

Best Practices for Organizing Your Financial Records

Organizing financial records is a critical component of sound financial management, and implementing best practices can significantly enhance this process.

Effective document categorization ensures that all records are systematically organized, facilitating easy retrieval.

Additionally, adhering to record retention guidelines helps maintain compliance and efficiency, minimizing the risk of loss or mismanagement.

These practices empower individuals to maintain clarity and control over their financial landscape.

Navigating Tax Deductions and Financial Reporting

Although navigating tax deductions and financial reporting can appear daunting, it is essential for individuals and businesses to understand the intricacies involved in optimizing their financial outcomes.

Implementing effective tax deduction strategies while adhering to financial reporting standards enables clearer insights into fiscal health.

Conclusion

In conclusion, mastering accounts through effective bookkeeping is crucial for financial success. A study by the Small Business Administration revealed that 30% of small businesses fail due to poor financial management, underscoring the importance of accurate record-keeping. By leveraging advanced tools and adhering to best practices, individuals and businesses can enhance their financial clarity and compliance. Ultimately, a systematic approach to bookkeeping not only facilitates better decision-making but also fosters a sustainable fiscal environment for future growth.